In an era of instant gratification and digital payments, teaching financial literacy to the next generation has never been more critical. Many young adults enter the workforce without a solid understanding of personal finance, which can lead to financial stress, debt, and missed opportunities for building wealth.

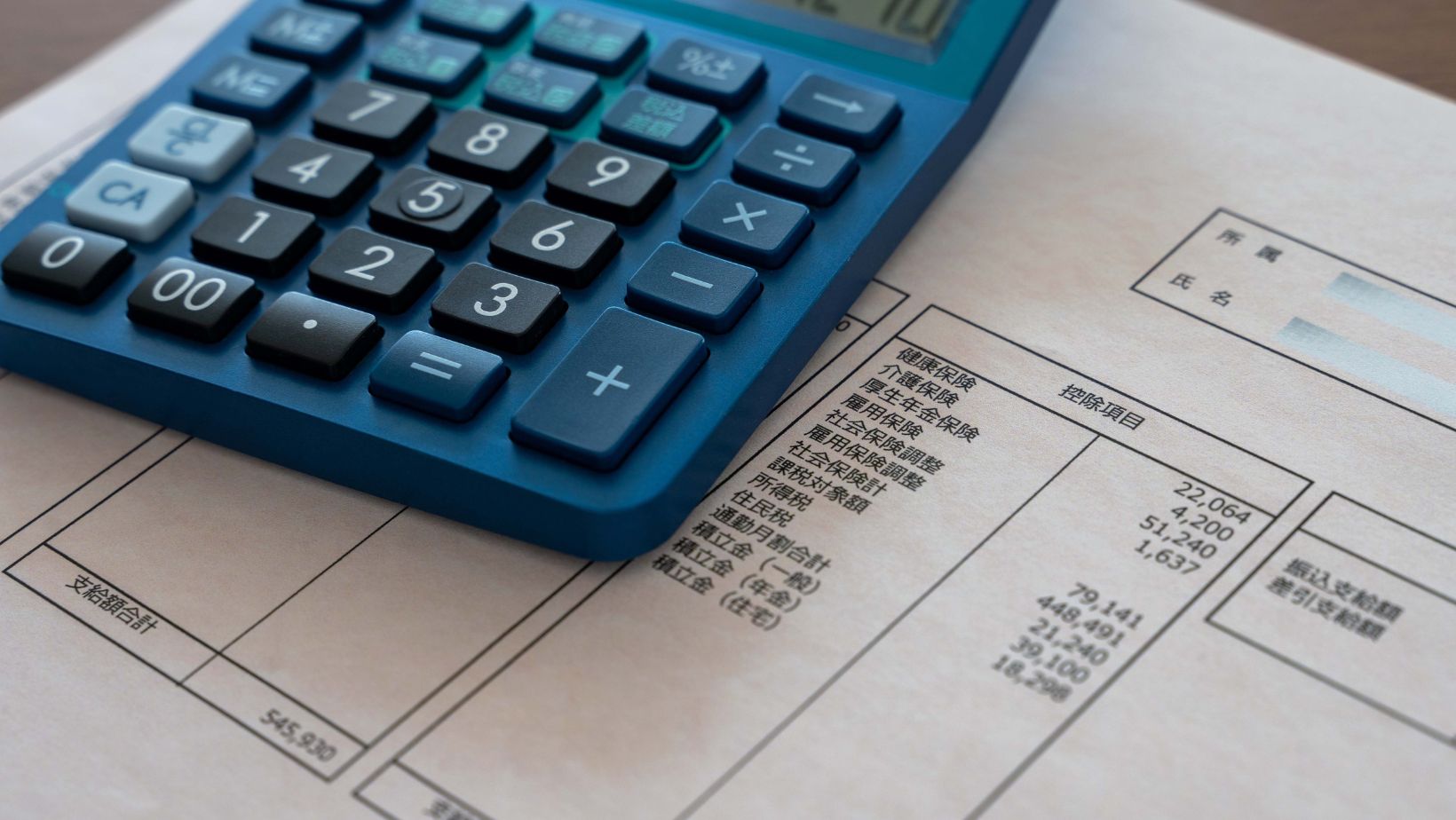

One often-overlooked tool for teaching financial skills is the humble pay stub. These documents, which detail an individual’s earnings and deductions, can serve as valuable educational tools to help individuals build essential financial skills for life.

Understanding the Basics of a Pay Stub

A pay stub, also known as a paycheck stub, is a document that accompanies an employee’s paycheck and which you can create with a pay stubs generator. It provides a breakdown of the employee’s earnings for a specific pay period, typically bi-weekly or monthly. A typical pay stub includes several key pieces of information:

Gross Earnings: This is the total amount an employee earned before deductions. It includes their hourly or salaried wages, as well as any overtime pay.

Deductions: Deductions include various amounts withheld from an employee’s gross earnings. Common deductions include income taxes, Social Security, and Medicare contributions, as well as deductions for health insurance, retirement contributions, and other benefits.

Net Pay: This is the amount an employee receives after all deductions have been subtracted from their gross earnings. It represents the actual take-home pay.

Year-to-Date (YTD) Information: Pay stubs often include year-to-date figures for gross earnings, deductions, and net pay. This information can help employees track their income and taxes over the course of the year.

Using Pay Stubs as Educational Tools

Pay stubs can be valuable educational tools for individuals of all ages, from teenagers just starting their first jobs to adults looking to improve their financial literacy. Here are some ways pay stubs can be used to teach financial skills:

Budgeting and Expense Tracking: Pay stubs provide a clear picture of income and deductions, making it easier for individuals to create a budget. By understanding their net pay and the various deductions taken from their earnings, people can better allocate their money to cover expenses, save, and invest.

Tax Education: Pay stubs often include information about income tax withholdings. This can be an opportunity to teach individuals about the basics of income taxes, including how they are calculated and the importance of filing tax returns accurately and on time.

Retirement Planning: Many pay stubs include deductions for retirement contributions, such as a 401(k) or a pension plan. Educators can use pay stubs to introduce the concept of retirement planning and the benefits of saving for the future.

Understanding Benefits: Pay stubs also highlight deductions related to employee benefits, such as health insurance premiums. This can lead to discussions about the importance of health insurance and other workplace benefits.

Debt Management: If an individual has student loans or other debts with automatic deductions, their pay stub can help them track how much they are paying towards their debts each month. This can be a starting point for discussions about debt management and strategies for paying off loans.

Setting Financial Goals: Pay stubs can serve as a baseline for setting financial goals. Individuals can identify how much they earn, how much they spend, and how much they save, helping them set realistic financial objectives.

Emergency Savings: Understanding net pay and expenses from pay stubs can highlight the importance of emergency savings. Individuals can see how much they have available for unexpected expenses and why it’s crucial to have an emergency fund.

Incorporating Pay Stubs into Financial Education

To effectively use pay stubs as educational tools, educators and parents can consider the following strategies:

Interactive Workshops: Conduct workshops or seminars where participants bring their pay stubs, and instructors walk them through the various components. This hands-on approach can make financial concepts more tangible.

Personalized Guidance: Offer one-on-one sessions where individuals can review their pay stubs with a financial advisor or educator. This allows for personalized guidance and addressing specific questions.

Budgeting Exercises: Have participants create budgets using their pay stubs as a starting point. Encourage them to allocate funds for different categories, such as housing, transportation, groceries, and savings.

Real-Life Scenarios: Use hypothetical scenarios based on pay stub information to teach financial lessons. For example, discuss how a change in income or an increase in deductions would impact an individual’s finances.

Online Resources: Develop online tools and resources that individuals can use to input their pay stub information and receive personalized financial advice and recommendations.

Financial Literacy Apps: Encourage the use of financial literacy apps that allow users to input pay stub data and track their financial progress over time.

Conclusion

Pay stubs may appear to be simple documents, but they hold a wealth of information that can be instrumental in teaching financial skills and promoting financial literacy. By using pay stubs as educational tools, individuals can gain a better understanding of their earnings, deductions, and overall financial health. This knowledge equips them with the skills and confidence needed to make informed financial decisions, plan for the future, and achieve financial well-being throughout their lives.

Bob Duncan is the lead writer and partner on ConversationsWithBianca.com. A passionate parent, he’s always excited to dive into the conversation about anything from parenting, food & drink, travel, to gifts & more!